DEBT MANAGEMENT SYSTEM

The debt management system allows for comprehensive debt management. It allows you to control the recovery (collection) of credit. It has mechanisms to automate the conversion of amounts involved in all stages of debt recovery from the list of receivables by foreign and own costs to interest. Built-in financial reporting system and an intuitive interface.

ACCOUNTING MECHANISM AND OPERATING PRINCIPLE

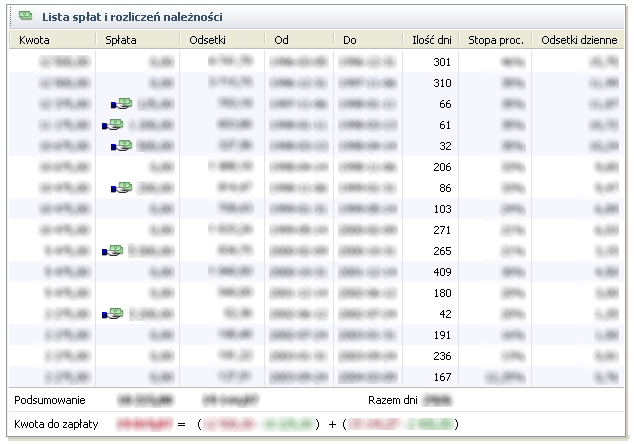

The main mechanisms of the billing system allow you to automatically calculate

- statutory interest including partial repayments

- settlement of payments for own costs, principal receivable, interest, etc.

- merge two or several receivables, including interest and principal amount into a new debt, to calculate interest of interest

- adding up and arbitrarily settling the total costs of each stage

DEBT SERVICE

CHARGE SERVICE

The system allows you to easily present and manage receivables included in the debts. It enables intuitive calculation of statutory interest and introducing partial payments for any receivables.

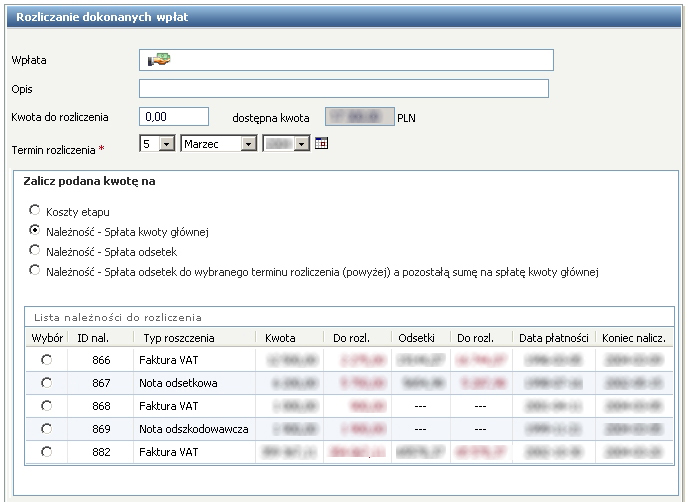

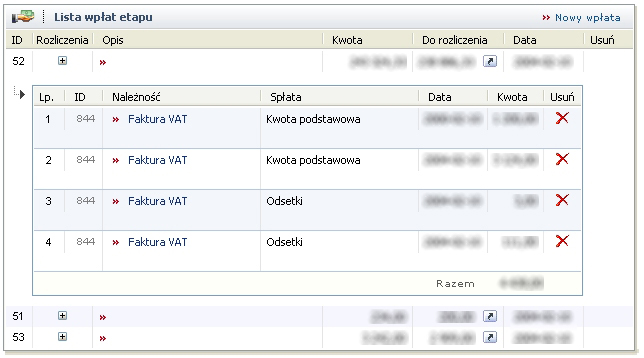

PAYMENTS SERVICE

Each stage (for example: court, bailiff) can have any number of payments, which should settle the costs of servicing the stage or repay the receivables in the form of settling the principal or interest. All settlements can be viewed in the hierarchical tree structure in which branches are settlements of individual payments.

COSTS SERVICE

All stages have the option of charging due to own costs incurred or costs of stage service. These costs can later be settled with payments made by the debtor.

STAGES SERVICE

Each recovery (collection) of debt consists of a number of stages. The system allows you to manage the debts stages in an intuitive way by counting payments made by the debtor in the selected stage or by summing own costs and costs obtained from the stage management arm.

INTEREST CALCULATORS

The system has calculators of statutory interes, court costs, costs of conducting cases and many other items needed to manage debts.

HISTORICAL DATES

Each debt has historic dates which in economic vocabulary are called "milestones" - they allow to determine the breakthrough periods of each debt. On the basis of these data, it is possible to analyze and compare debts in order to capture dependencies and to obtain a picture of the expenditure of funds.